Quickbooks Premier 2018 Mac

Important Disclosures. Please Read Carefully.

Intuit QuickBooks PRO 2018 - Retail Green Box Package - Authentic Intuit Product. QuickBooks Desktop Premier 2018 2-User. 3.7 out of 5 stars 3. CD-ROM $549.95 $ 549. QuickBooks Desktop for Mac 2020 Accounting Software for Small Business with Shortcut Guide Mac Download by Intuit. 4.0 out of 5 stars.

Quickbooks Premier Manufacturing 2018

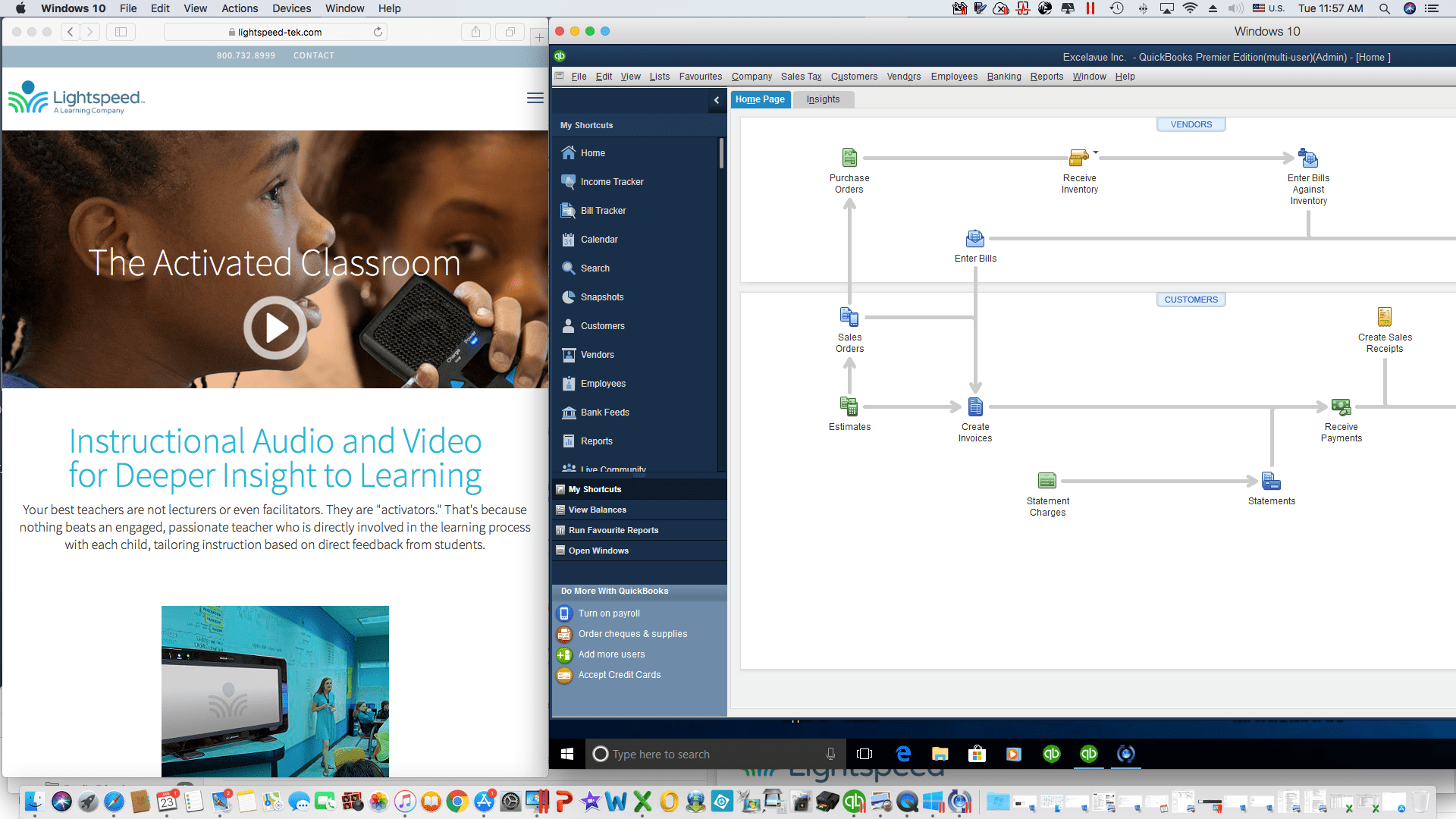

- QuickBooks® 2018 has what you need to boost your workflow - Help get customers to pay you faster with Past Due marked invoices - Compare business performance on a cash or accrual basis with one click - Save time with a new searchable Chart of Accounts.

- Quickbooks Pro is actually one of three versions of desktop products currently offered by Intuit, the other two being Quickbooks Premier and Quickbooks Enterprise 18.0. Under the Quickbooks Pro umbrella, Intuit maintains a few different options.

- Intuit QuickBooks Desktop 2020 for Mac Os ( Download + Activation Key )🔥 70%OFF. Intuit QuickBooks Desktop for Mac 2020 Small Business Accounting. Intuit 433529 QuickBooks Desktop Premier 2018 - 1 User. 4.9 out of 5 stars (7) Total Ratings 7, 100% agree.

- QuickBooks Desktop Premier 2018 2-User. Intuit QuickBooks Desktop For Mac 2019 Mac DiscOld Version Sep 17, 2018 by Intuit. 3.4 out of 5 stars 59.

Quickbooks Premier 2018 Manual

Persons facing serious financial difficulties should consider other alternatives or should seek out professional financial advice. This website is not an offer to lend. Lendgenius.com is not a lender or lending partner and does not make loan or credit decisions. Lendgenius.com connects interested persons with a lender or lending partner from its network of approved lenders and lending partners. Lendgenius.com does not control and is not responsible for the actions or inactions of any lender or lending partner, is not an agent, representative or broker of any lender or lending partner, and does not endorse any lender or lending partner. Lendgenius.com receives compensation from its lenders and lending partners, often based on a ping-tree model similar to Google AdWords where the highest available bidder is connected to the consumer. Regardless, Lendgenius.com’s service is always free to you. This service is not available in all states. If you request to connect with a lender or lending partner in a particular state where such loans are prohibited, or in a location where Lendgenius.com does not have an available lender or lending partner, you will not be connected to a lender or lending partner. You are urged to read and understand the terms of any loan offered by any lender or lending partner, and to reject any particular loan offer that you cannot afford to repay or that includes terms that are not acceptable to you. By submitting your information via this website, you are authorizing Lendgenius.com and/or lenders and lending partners in its network or other intermediaries to do a credit check, which may include verifying your social security number, driver license number or other identification, and a review of your creditworthiness. Credit checks are usually performed by one of the major credit bureaus such as Experian, Equifax and Trans Union, but also may include alternative credit bureaus such as Teletrack, DP Bureau or others. You also authorize Lendgenius.com to share your information and credit history with its network of approved lenders and lending partners. For qualified consumers, our lenders offer loans with an Annual Percentage Rate (APR) of 35.99% and below. For qualified consumers, the maximum APR (including the interest rates plus fees and other costs) is 35.99%. All loans are subject to the lender’s approval based on its own unique underwriting criteria. Example: Loan Amount: $4,300.00, Annual Percentage Rate: 35.99%. Number of Monthly Payments: 30. Monthly Payment Amount: $219.36. Total Amount Payable: $6,581.78 Loans include a minimum repayment plan of 12 months and a maximum repayment plan of 30 months. In some cases, you may be given the option of obtaining a loan from a tribal lender. Tribal lenders are subject to tribal and certain federal laws while being immune from state law including usury caps. If you are connected to a tribal lender, please understand that the tribal lender’s rates and fees may be higher than state-licensed lenders. Additionally, tribal lenders may require you to agree to resolve any disputes in a tribal jurisdiction. You are urged to read and understand the terms of any loan offered by any lender, whether tribal or state-licensed, and to reject any particular loan offer that you cannot afford to repay or that includes terms that are not acceptable to you.